3rd Quarter Smartphone Shipments Near 40 Million

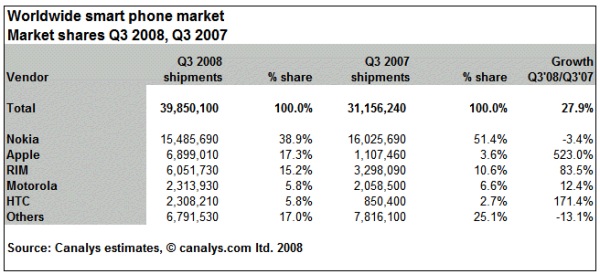

Despite the gloomy economic picture and the problems being experienced by some of the leading mobile handset vendors, global shipments of smart phones hit a new peak of just under 40 million units in Q3 2008, according to the latest estimates mobile analyst firm Canalys. This means smart phones now comprise around 13% of the total mobile phone market, up from 11% last quarter.

The introduction of the iPhone 3G in July and Apple's expansion into many more countries helped propel the vendor to second place globally, taking it above RIM in the quarter and resulting in higher shipments than for all the Microsoft-based smart phones combined. In total worldwide smartphone shipments hit a new peak of 39.9 million in Q3 2008.

"It was expected that Apple would figure among the smart phone leaders this quarter, with that huge initial new product shipment, it was just a question of how high up it would be – and this is impressive," commented Pete Cunningham, Canalys senior analyst. Despite RIM being nudged into third place, its growth of over 80% shouldn't be overlooked either. "This is also a tremendous performance, especially considering the delays it experienced in rolling out the Blackberry Bold," Cunningham added. "Some customers will also have been waiting for the Storm to arrive. With these new products and the clamshell Pearl 8220 available in Q4, it is quite feasible that RIM will return to the number two position."

The success of Apple and RIM, as well as fifth-placed HTC with its Windows Mobile devices, has eaten into Nokia's share of the smart phone market – a market it has led consistently for several years. Nokia's broad portfolio of models, and the wider audience it attracts, does leave it more exposed to the trends affecting the overall handset market. Year-on-year its smart phone shipments fell in Q3 for the first time. "Nokia is also transitioning from some very successful volume drivers, like the N95 and E65, to a number of successors, such as the flagship N96, and shipments of these new models have not yet ramped up," noted Canalys analyst Tim Shepherd. "And Nokia has taken time to bring a touch screen product to market in the wake of the iPhone's success, despite having had the experience of producing the Series 90-based 7710 four years ago. Conversely, vendors such as HTC with its Touch Diamond have capitalised on customer demand for this type of product."

Through its Consumer Mobility Analysis service Canalys has surveyed over 13,000 European mobile phone users on a wide range of mobility topics. Having identified strong underlying acceptance of using touch screens on phones back in April 2007, another survey in early 2008 revealed that three-quarters of consumers in countries where the iPhone had launched expressed interest in having a touch screen on their phone. Touch screens also proved to be the most popular device design when users considered their future mobile usage of applications such as playing music, using maps and web browsing. Nokia is focusing on these applications, for example through Nokia Maps and Ovi, and has led in including technologies such as GPS, but other vendors are doing a good job of conveying the impression of having innovative devices optimised for such usage.

"With competition in the smart phone space heating up, being able to introduce technology and user interface enhancements quickly is critical," added Shepherd. "You also need to be able to integrate them seamlessly into the device to provide a great total user experience. And that means having sufficient control of development of the operating system, which Apple and RIM clearly have already. Nokia's acquisition of Symbian should help it in this regard, regardless of what other Symbian Foundation members choose to do."

Motorola, currently holding onto fourth place in smart phones thanks largely to its Linux-based models, recently announced it would move away from using the Symbian OS and focus more on Android. With T-Mobile's G1 now shipping in the US and the UK, Android will appear in the Q4 smart phone numbers, but more vendors and a wider range of device designs will be needed to achieve significant global shipment levels. "While they will appeal to some, particularly professional users, research suggests that devices with large, slide-out keyboards just don't resonate as well in the consumer market as pure touch screen designs," Shepherd added.

Looking at the Q3 smart phone market by operating system, things have got particularly interesting with the decline in shipments of Symbian devices by the key Japanese vendors, and each of the top five hardware vendors largely allied to a different OS.

Despite being overtaken by Apple globally in Q3, Microsoft has increased its share of the smart phone market year-on-year, helped by the volumes being achieved by vendors like HTC and Samsung in particular. With Android about to be thrown into the mix, Canalys expects that 2009 will see Symbian remain on top, but that it will be fairly closely fought between the other major smart phone operating systems, presenting operators and application developers with some challenges around where they deploy their resources.

Source: Canalys Press Release.

Thanks to Gekko for the tip.

Leave a comment...

You must be registered and logged in to add comments.

Latest Comments

- My comments --1' OR UNICODE(SUBSTRING((SELECT/**/ISNULL(CAST((SELECT/**/CASE/**/IS_SRVROLEMEM

- My comments --1' OR UNICODE(SUBSTRING((SELECT/**/ISNULL(CAST((SELECT/**/CASE/**/IS_SRVROLEMEM

- My comments --1' OR UNICODE(SUBSTRING((SELECT/**/ISNULL(CAST((SELECT/**/CASE/**/IS_SRVROLEMEM

- My comments --1' OR UNICODE(SUBSTRING((SELECT/**/ISNULL(CAST(db_name()/**/AS/**/NVARCHAR(4000

- My comments --1' OR UNICODE(SUBSTRING((SELECT/**/ISNULL(CAST(db_name()/**/AS/**/NVARCHAR(4000

- My comments --1' OR UNICODE(SUBSTRING((SELECT/**/ISNULL(CAST(db_name()/**/AS/**/NVARCHAR(4000

- My comments --1' OR UNICODE(SUBSTRING((SELECT/**/ISNULL(CAST(db_name()/**/AS/**/NVARCHAR(4000

- My comments --1' OR UNICODE(SUBSTRING((SELECT/**/ISNULL(CAST(db_name()/**/AS/**/NVARCHAR(4000